Recently, the Government has assigned the State Bank of Vietnam to lead and coordinate with the Ministry of Justice and relevant agencies to study and propose the Prime Minister to promulgate a Decision on piloting the use of telecommunications accounts. to pay for small-value services (Mobile – Money), to pilot new payment service models while there is no law to promptly ensure the management, especially for cross-border payment activities.

* Diverse forms of non-cash payment

Mr. Nguyen Xuan Song, Head of Corporate Banking Department of Bank for Investment and Development of Vietnam (BIDV), Bien Hoa branch, currently, most of the bank’s customers have used unused payment types. cash. The Bank has also implemented many activities to collect electricity and water bills … through such forms as Internet Banking, Mobile Banking, automatic debt collection. In addition, the bank also deployed more applications (app) on smartphones (smartphones) to support customers more conveniently when conducting online transactions.

Many companies, supermarkets, trade centers … have expanded many forms of payment such as: supporting payment by cards of most banks, applying consumer payment applications through integrated app in smartphone …

According to Mr. Truong Dinh Quoc, Deputy Sales Director of Dong Nai Power One-member Co., Ltd. (PC Dong Nai), in recent years, the company has expanded its electricity payment channels, signed cooperation contracts. With banks, intermediary payment organizations such as MoMo, ZaloPay, VNPay, Payoo, Airpay, ViettelPay … so that customers can conveniently pay for electricity through the collection points of banks, ATM cards, shops gadgets, supermarkets, or electronic payments …

Besides, Dong Nai PC has also launched a customer care app on smartphones. With this care app, customers can look up information on electricity usage, electricity bills, schedule to stop reducing electricity supply of customers and information of the Government and the electricity industry quickly and promptly.

Ms. Tran Thi Phuong Hien, Director of An Binh Commercial Joint Stock Bank (ABBank) in Dong Nai branch, said that besides coordinating with Dong Nai PC to deploy electricity payment activities in the form of non-money payment. On the other hand, the bank also deployed other online payment channels; At the same time, promoting communication to customers on how to use cards to pay for services, the utility of non-cash payment to gradually familiarize customers with card payment methods, electronics …

* Improved security

In order for the people to pay more and more attention to the form of non-cash payment which requires synchronization when deploying online payment channels; The State needs to invest in building infrastructure for people to use conveniently, as well as more incentives and incentives for individuals using cards and modern means in payment of public services …

According to Directive No. 01 / CT-NHNN of the State Bank of Vietnam in 2020, the task of promoting non-cash payment of the banking industry needs to renovate and complete information technology infrastructure and technology applications. modern to develop digital banking services; enhance security, safety and confidentiality in banking activities.

Mr. Pham Quoc Bao, Deputy Director of the State Bank of Vietnam, Dong Nai branch shared that, in order to achieve the goal of non-cash payment, the unit will direct commercial banks in the province. strengthening coordinated coordination in joining hands to contribute to changing the habits in people’s spending, modernizing technology, strengthening security, continuing to improve the legal corridor; ensure personal and safe information when cardholders lose cards …

Commercial banks in the province are actively offering new products and services, especially in coordination with state agencies and units, to organize non-cash payment methods for many public services, including strongly propagating and applying forms of online payment, card payment for the fields of health, education, pension payment, social insurance …

Tin tức khác

Add a lock for more safety when paying for your card

Some regulations are expected to be added by the State Bank to ensure safer and more secure card payments. The State Bank is currently drafting an amendment to Circular 47 providing technical requirements for safety and security with facilities for bank card payments. Accordingly, for operating accounts and administrative accounts, banks and payment intermediaries need

Xem chi tiết

Transact safer with ACB Green domestic debit card

Catching up with the 4.0 technology trend, the ACB Green domestic debit card according to VCCS standard (Vietnamese chip card technical standard) is deployed to apply contactless technology (contactless payment) to provide a quality experience. quality for young people. Safety and high security As one of the pioneering banks to grasp the inevitable trend of

Xem chi tiết

Converting a magnetic card to a chip card: A new year’s goal for the banking industry

According to the goals set by the Government, by 2020, the rate of non-cash payment must account for more than 30% of the total means of payment in Vietnam. Conversion of magnetic cards to chip cards with safer security technology is a must. The conversion from magnetic stripe to chip card is being implemented by

Xem chi tiết

Conversion of electronic health insurance card: What do people get?

During the transition period to electronic cards, Vietnam Social Insurance still ensures full benefits of patients From January 1, 2020, the Vietnam Social Insurance agency will issue an electronic health insurance card with a chip attached to the participants of health insurance instead of paper cards. Also from this point, the Ministry of Health has

Xem chi tiết

Điều cần biết khi thay thẻ bảo hiểm y tế giấy bằng thẻ điện tử

Từ năm 2020, thẻ bảo hiểm y tế giấy như hiện nay sẽ được thay thế bằng thẻ điện tử. Theo lộ trình, chậm nhất ngày 1-1-2020, Cơ quan bảo hiểm xã hội (BHXH) phải thực hiện phát hành thẻ bảo hiểm y tế (BHYT) điện tử cho người tham gia BHYT. Theo BHXH Việt

Xem chi tiết

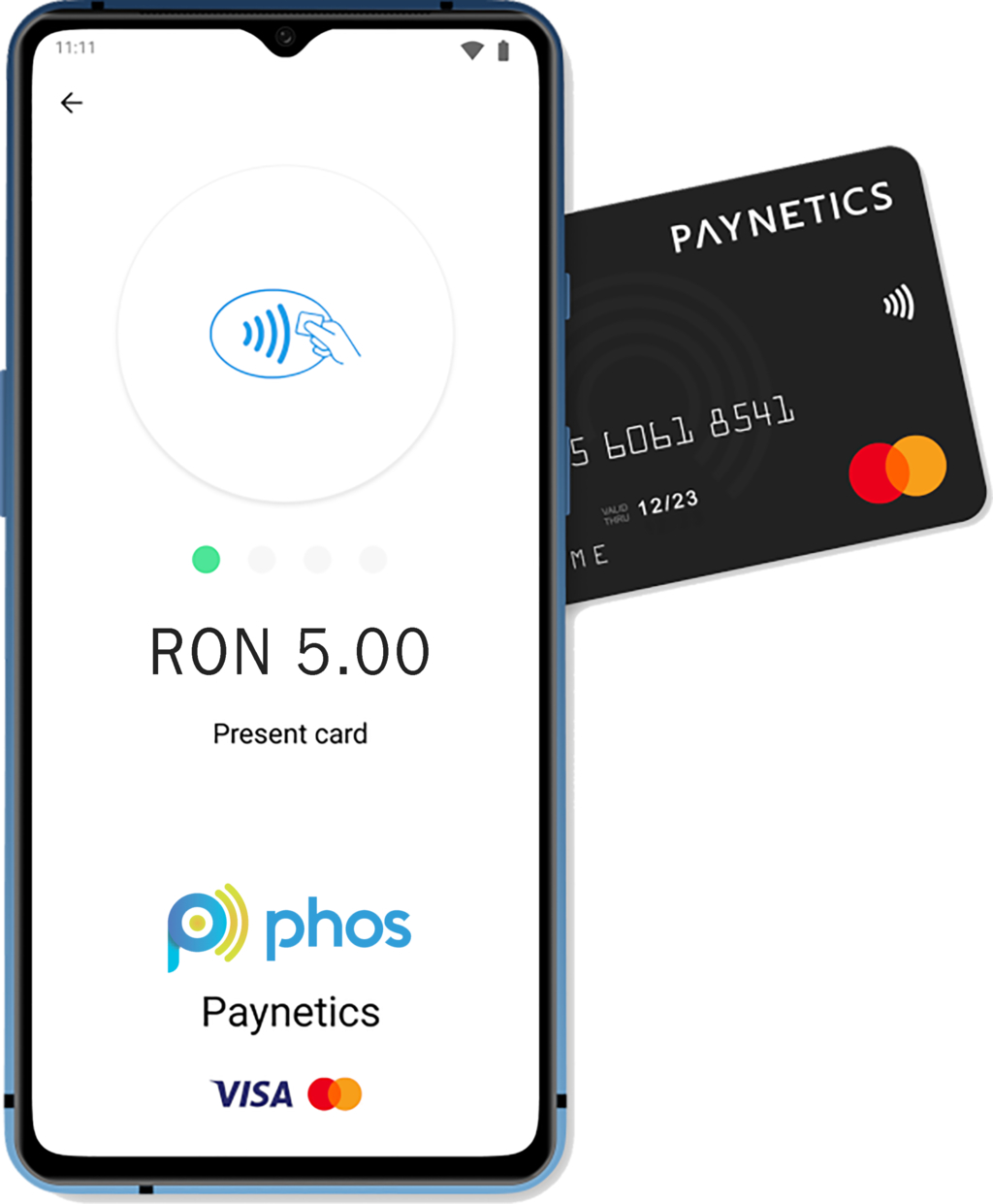

4 EUROPEAN COUNTRIES PAYMENT WITHOUT EXPOSURE WITHOUT ANDROID NFC AND PHONE

Merchants in 4 countries including the UK, Germany, Bulgaria and Romania will participate in testing the new mobile POS service (mPOS) to allow contactless payments to be accepted on Android mobile devices without the need for additional any “lock or hardware”. Mastercard has partnered with new software companies Phos and Paynetics specializing in mobile POS

Xem chi tiết