Under the direction of the State Bank, Vietnam Bank Card Association (VBCA) in collaboration with Vietnam National Payment Corporation (NAPAS) officially launched domestic chip card products. The Securities Investment Newspaper had an interview with Mr. Tran Cong Quynh Lan, Deputy General Director of VietinBank, one of the first 7 banks to deploy this event.

Switch from magnetic card to chip card, according to him, what should customers pay attention to?

Like a magnetic card, the local debit card Epartner chip of VietinBank is linked to the DDA payment account and uses the balance on the account to make payment and withdrawal transactions. The biggest difference is that the card is applied with new technology, complying with safety and security requirements.

For chip cards with contactless payment feature, customers can experience non-touch payment by simple operation, saving time, without revealing PIN …

Is there a risk when switching to a chip card that customers need to pay attention to?

Different from magnetic cards, chip cards are safer with security parameters that change with each transaction, so it is difficult to copy or fake. With high information security ability, the conversion from magnetic card to chip card is not a risk.

VietinBank is one of the first 7 banks to deploy internal chip cards. So what are the benefits to customers in switching to chip cards?

VietinBank pioneered the implementation of domestic chip card deployment by helping overcome some of the disadvantages of magnetic card payment today, helping to further improve the card service provided to customers.

Firstly, it is information security. With the encryption of information on the chip, the processing mechanism is different from the magnetic card to help prevent fraud and copying of card information. Therefore, customers can feel secure when using chip card than magnetic card.

Secondly, the payment is made quickly and easily. Especially, with the chip card with non-contact function, one-touch transactions bring convenience, enhance customer experience and help enhance the habit of not using cash.

In addition, through memory, chip cards can store personal information, insurance information, application information connecting payment expansion to fields, aiming to become a versatile card in the future. .

With the supposedly superior benefits, in your opinion, in the current conditions of Vietnam, is it possible to promote the conversion of chip cards?

Chip cards are the inevitable trend of card payments. In many countries around the world, the transition to full chip card use was made a few years ago. According to EMVCo data, as of the fourth quarter of 2018, the percentage of EMV Card-

present worldwide accounts for 73.6%, showing that the use of chip cards is happening quickly. Even in some countries and territories such as Singapore, Malaysia, Taiwan … have combined chip cards with other utilities, such as one-touch traffic payment.

In Vietnam, the State Bank has built a roadmap for chip card conversion from now to the end of 2021. Accordingly, all domestic debit cards will be converted / issued by new chip cards. Up to now, 7 joint stock commercial banks, including VietinBank, are ready for infrastructure and technology resources to convert magnetic card to chip card.

In the coming time, banks will take advantage of the issuance of chip cards combined with non-contact features, payment applications to thereby build a card payment ecosystem to better serve the needs of customer.

In case customers do not want to change the card to chip card, what is the solution of VietinBank?

The main purpose of converting chip cards is to increase security and safety when using the cards. At the same time, with contactless payment, customers will experience convenient, non-touch payment technology, saving time …

At VietinBank, card conversion procedure will be very quick and simple. Customers can go to any branch / transaction office of VietinBank to reissue after the Bank has widely deployed this card. On-site card delivery service can be applied to create added value for customers.

VietinBank develops a plan to promote communication, increase customer awareness about the features and advantages of the card with new technology. Thereby, encourage customers to proactively propose to switch to chip cards.

With the development of technology and comprehensive communication efforts, VietinBank believes that customers will see the benefits and inevitable trend of the conversion to actively implement.

VietinBank will also carry out solutions to minimize risks for customers when using the card. Complete peace of mind with comprehensive insurance services for domestic debit cards.

In addition, the conversion of chip cards is according to the schedule and limits set by the State Bank. Therefore, by December 31, 2021, if customers do not convert, the bank will not be able to provide domestic debit card services to customers.

(Source: Securities Investment Review)

Tin tức khác

Top 10 most typical IT events in 2019

TTO – Revolution 4.0, E-Government, AVG trial, 5G network testing … were voted as the top events in the top 10 ICT 2019 events Top 10 most typical IT events in 2019 – Photo 1. In 2019, Vietnam announced the strategy of “Make in Vietnam” with the goal of proactively, creating, designing, integrating products in

Xem chi tiết

Covid-19 season, super convenient shopping thanks to online payment

From shopping all kinds of goods, ordering food regardless of the morning … to paying the daily bills through online utility applications are all very popular in modern life, especially in times of social isolation space today. No need to step out of the house, just a smartphone or a computer, you can freely choose

Xem chi tiết

Convert magnetic card to chip card: Increase utility and security for customers

According to the State Bank of Vietnam (SBV), from March 31, 2021, banks will stop issuing magnetic ATM cards to convert to ATM chip cards, in order to increase convenience and security for customers. row. Talking to Dong Nai Newspaper’s reporter on this issue, Deputy Director of the State Bank of Vietnam, Dong Nai branch

Xem chi tiết

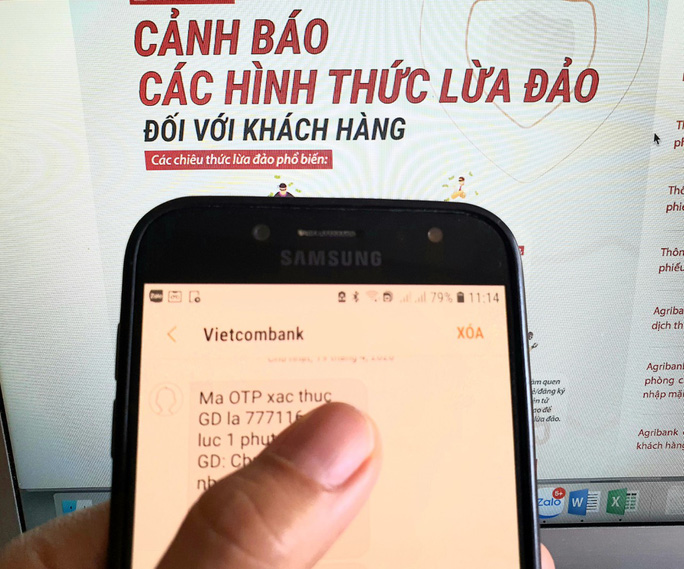

Add a bank alert trick trick to steal money in the account

Although banks have repeatedly warned of high-tech criminals cheating on OTP codes, requiring login to fake bank websites to steal customers’ money, there are still many people trapped. Agribank has continued to warn tricks of branding, website, relatives, bank officials, postal staff, law enforcement agencies … with many scenarios to steal customers’ account information. ,

Xem chi tiết

Smart card development history

A smart card, chip card, or integrated circuit card (ICC) is a pocket card typically the size of a credit card that contains an integrated circuit capable of storing and processing data. information. It can act as an identification card, perform information authentication, store data or be used in card applications. There are two main

Xem chi tiết

Thanh toán điện tử tăng đột biến trong Covid-19

Người dùng chuyển sang thanh toán qua thẻ, ứng dụng di động, mã QR… để tăng an toàn và tiện lợi trong Covid-19, đồng thời hưởng ưu đãi từ ngân hàng. Chưa từng dùng ứng dụng ngân hàng để thanh toán hóa đơn, chị Thu Hồng (quận 8, TP HCM), bất ngờ vì tính tiện

Xem chi tiết