Deputy Prime Minister Vu Duc Dam said that the Government has instructed industries such as tax, insurance, telecommunications and electricity to apply non-cash payments …; in which two fields, education and health, must be implemented before 2020.

At the Forum of developing electronic payment ecosystem 2019 with the topic “Moving with chip technology”, Deputy Prime Minister Vu Duc Dam reiterated the story of Vietnam Post has bravely went straight to the 2G network, even in other countries. nearby free technology transfer is more backward. As a result, Vietnam is one of the pioneers in 2G technology.

“Similarly between current chip and magnetic card technology, if we boldly take a step forward, we will not miss the beat” – Deputy Prime Minister exchanged in the Forum of Electronic Payment Ecosystem Development 2019 .

Deputy Prime Minister said, the Government has directed the sectors such as tax, insurance, telecommunications, electricity to apply non-cash payments …; in which two fields, education and health, must be implemented before 2020.

“Now a lot of farmers and poor people still think that bank accounts are not for themselves, changing this mindset is the duty of the State Bank, the banking system, credit institutions, the media … “, Deputy Prime Minister noted and said that it is necessary to strongly apply technology, proceed to integrate personal information about personal identity, health insurance, social insurance, banking … at the same time, coordinate the contract. ministries among ministries, organizations, enterprises, mobilizing and explaining for people to participate.

“Vietnamese people have a saying that“ money comes with their intestine ”, therefore, the issue of safety and security in payment to the people is the most practical thing. Therefore, in order to promote electronic payment, to take advantage of the digital economic opportunity, we need to attach it to safety and security and make sure the benefits of participation for all citizens “- Deputy Prime Minister Vu Duc Dam to speak.

Experts said that promoting electronic payment towards cashless society is an inevitable development trend in the context of the Fourth Industrial Revolution, creating a double impact that has spurred economic growth. International financial assistance has supported the implementation of a comprehensive financial strategy through the universalization of banking and financial services.

According to the State Bank, as of September 30, the value of payment via POS increased by 36.5% over the same period; the number of cards reached 96.4 million; more than 19,000 ATMs … These are the basis for promoting electronic payment mobile banking and internet banking. However, the transition to chip cards is also new content, there are many challenges and challenges.

The main reason today is due to the large banking costs. Investing in old technology requires a period of depreciation, while when applying a chip card, the system of technology must change, the terminal system, ATM tree, POS system must change.

In addition, when switching to chip cards, banks have to change a series of machines, chip card issuance costs are also much higher than magnetic cards. However, banks have realized that it is necessary to convert and are determined to transfer magnetic cards to chip cards, turning challenges into opportunities with integrated, synchronous payment of many expenses such as education and health. , insurrance…

Up to now, there are more than 20 banks and 6 institutions providing chip cards, expected by the end of the first quarter of 2020, this figure will reach 26 banks, 10 companies providing chip cards …

(Source: Life Health Newspaper)

Tin tức khác

Máy POS (Point of Sale) là gì? Các cách thanh toán qua máy POS

Máy POS (tiếng Anh: Point of Sale) là các máy chấp nhận thanh toán thẻ, máy POS sẽ kết nối Internet với ngân hàng tiến hành thanh toán khi có yêu cầu từ khách hàng. Máy POS (Point of Sale) Khái niệm Máy POS trong tiếng Anh là Point of Sale. Máy POS (Point of Sale) là các

Xem chi tiết

Cơ hội đẩy mạnh phổ cập thanh toán không dùng tiền mặt

Trước biến cố dịch bệnh thanh toán online đã chứng minh lợi thế và đây là “cơ hội” để phát triển các loại hình thanh toán không dùng tiền mặt. Việt Nam có tận dụng được cơ hội này hay lại bỏ lỡ? Thời cơ đặc biệt Theo Bộ trưởng Bộ Thông tin và Truyền

Xem chi tiết

Health sector implements non-cash payment

Making a cashless payment has many benefits compared to using cash such as: Safe, fast, accurate, and transparent. Patients also save time, thereby increasing access to health services. Up to now, 100% of hospitals have implemented the application of information technology (IT) in hospital management at different levels, some hospitals have initially implemented electronic medical

Xem chi tiết

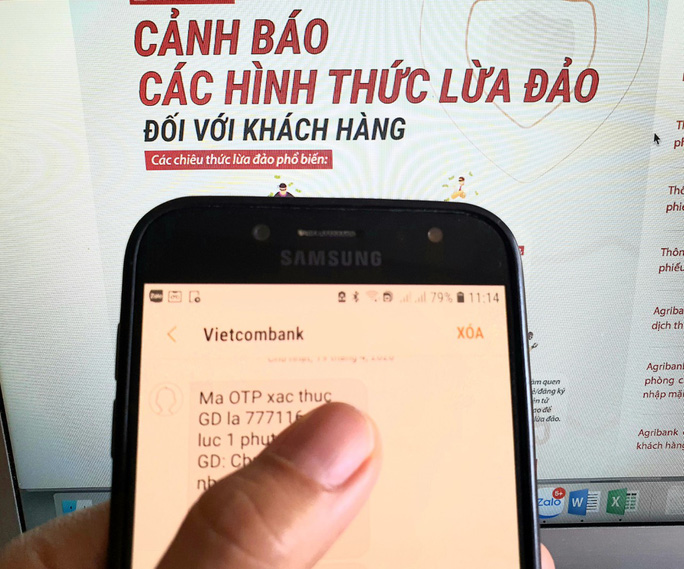

Add a bank alert trick trick to steal money in the account

Although banks have repeatedly warned of high-tech criminals cheating on OTP codes, requiring login to fake bank websites to steal customers’ money, there are still many people trapped. Agribank has continued to warn tricks of branding, website, relatives, bank officials, postal staff, law enforcement agencies … with many scenarios to steal customers’ account information. ,

Xem chi tiết

SCB triển khai chuyển đổi thẻ thanh toán CHIP nội địa chuẩn VCCS

Với định hướng trở thành ngân hàng bán lẻ đa năng, hiện đại, Ngân hàng TMCP Sài Gòn (SCB) không ngừng ứng dụng công nghệ vào việc nâng cao chất lượng sản phẩm dịch vụ và gia tăng sự an toàn, bảo mật, nhằm mang đến cho Khách hàng những trải nghiệm tuyệt vời nhất.

Xem chi tiết

Surf, wave lightly the card can be paid on Vietbank Digital

Facing the complicated situation of Covid-19, Vietbank transactions will switch to online or limit contact to ensure safety for themselves, their families and the community. Recently, Vietnam Thuong Tin Commercial Joint Stock Bank (Vietbank) has successfully implemented CHIP / EMV cards, launched contactless payment via Contactless technology for domestic and international cardholders including customers. issuing

Xem chi tiết