Possessing a variety of security authentication methods to ensure safe, fast transactions, streamlined processing, etc., TPBank is affirming its leading position in the digital card trend in the Vietnamese card market.

Electronic PIN, 3D Secure authentication method or contactless payment feature are digital technologies applied by Tien Phong Commercial Joint Stock Bank (TPBank) several years ago to ensure the best safety for customers. line.

Pioneering in applying security measures for online transactions

Understanding that safe transaction is a basic condition that all customers are interested in, as well as a requirement and prerequisite for the decision of every customer when using the card, TPBank soon researched and put devise best digital technologies to better protect card information.

To avoid card fraud when online transactions, since 2017, TPBank has implemented the 3D Secure feature for all international credit and debit cards issued by TPBank to increase safety by increasing One extra security step at checkout.

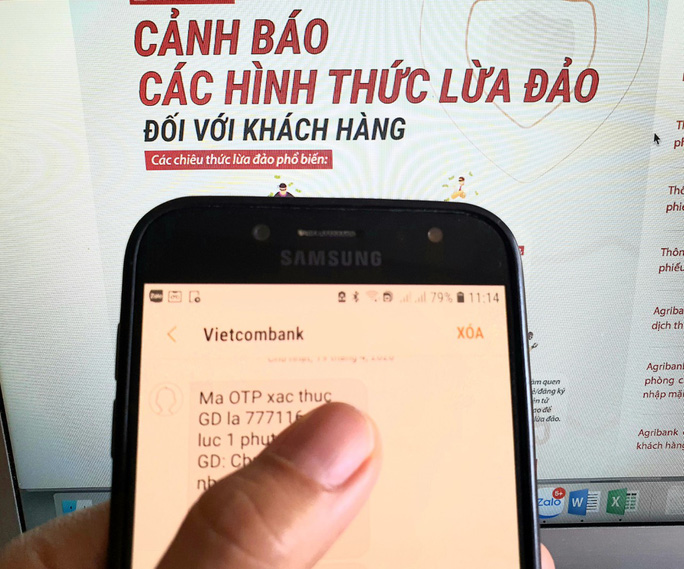

3D Secure is a global security solution that allows customers to authenticate transactions with 3 levels of security including card information, CVV numbers and authentication codes. This verification code is issued by TPBank, based on the standards of international card organizations. Customers can get this code via OTP SMS, Hard Token or eToken of TPBank.

After more than 2 years of implementation, from one of the first banks to apply, so far, many other banks have applied this feature to support the security of credit cards.

Pioneering successful application of 100% of global EMV chip card technology combined with contactless (contactless), TPBank has provided customers with the most advanced payment transaction security solution today.

With this technology, customers only need to touch the card on the POS / mPOS machine to accept wireless payments with the Visa payWave logo and they can pay instead of having to swipe the card over the magnetic strip in the traditional way. This solution helps protect cardholders’ rights and avoid risks that may arise such as fraudulent transactions and card information theft. In particular, the application of TPBank EMV chip card technology is not only applied to credit cards but has been replicated, and 100% of TPBank ATM cards are now also issued under this technology standard.

TPBank cardholders can also integrate their credit cards on the TPBank QuickPay electronic payment app (QR code payment application) around the globe through scanning QR codes at VNPay payment points. , Visa, Mastercard … This payment method helps cardholders feel secure in keeping their card information confidential.

Pioneer in technology application

In addition to security issues, ensuring fast and convenient transactions is also an issue focused by TPBank. The Bank constantly researches and applies technology, replacing traditional methods with electronic applications, bringing convenience to customers during the transaction process. In particular, worth mentioning is the electronic PIN feature ePIN and MyGo app.

While other banks are still releasing batteries in the usual way, which is both time-consuming and expensive, at TPBank, the ePIN (electronic PIN) feature has been officially applied since 2017. Features This has brought a lot of convenience, helped shorten waiting time as well as save a lot of costs for customers while ensuring the safety of services.

If previously, cardholders had to wait 3-7 working days to receive traditional paper PIN, now with electronic PIN, this process is much more streamlined. Customers will receive a PIN, activate the card and use it immediately with just a few basic messaging operations on mobile phones.

In 2019, TPBank launched the MyGo application – one of three products integrated for TPBank Visa Free Go card. With this application, customers can register and open the non-physical TPBank Visa Plus international payment card immediately with just a few taps on their mobile phones.

TPBank representative said: “TPBank Visa Plus card was issued to meet the needs of shopping and online payment safely and conveniently for customers. The card is valid for 5 years and has all the features and security regulations required by Visa and meets the PCI DSS security standards built by the world’s leading international payment card organizations. erection ”.

-Source: Vietnamnet-

Tin tức khác

Ngân hàng Việt khó được giảm phí thẻ quốc tế

Các ngân hàng Việt đang đề xuất các tổ chức phát hành thẻ quốc tế như Visa, MasterCard giảm phí thẻ khi doanh thu từ hoạt động này giảm mạnh do tác động của bệnh dịch, nhưng khả năng được giảm phí không cao. Hiệp hội Ngân hàng Việt Nam (VNBA) cho biết, đại dịch

Xem chi tiết

3D-Secure – secure technology for card transactions

With outstanding advantages of safety – security – convenience, 3D-Secure has been well received and used by Vietcombank cardholders. Recently, the Bank for Foreign Trade of Vietnam (Vietcombank) has invested heavily in technology systems, prioritizing the use of infrastructure and application of the most advanced, modern and most secure technology, ensuring transaction support. Card payment,

Xem chi tiết

Dịch Covid-19 ảnh hưởng thế nào đến ngành công nghệ toàn cầu?

Virus Corona chủng mới gây dịch Covid-19 đang giáng một đòn nặng vào nền kinh tế toàn cầu với hậu quả cực kỳ nghiêm trọng, vượt xa các trận dịch trước đây. Năm 2003, khi đại dịch SARS bùng phát ở Trung Quốc rồi lan ra cả thế giới (làm 8.096 người nhiễm bệnh và gây tử vong cho 774 người) đã làm

Xem chi tiết

Mùa dịch Covid-19, mua sắm siêu tiện lợi nhờ thanh toán online

Từ mua sắm đủ loại hàng hóa, gọi món ăn bất kể sáng tối… cho đến thanh toán các loại hóa đơn hàng ngày thông qua các ứng dụng tiện ích online đều đang rất thịnh hành trong cuộc sống hiện đại, đặc biệt là trong thời gian cách ly xã hội như hiện nay.

Xem chi tiết

Tích cực chuyển đổi thẻ từ sang thẻ chip

Xu thế hiện nay trên thế giới là chuyển đổi sang thẻ chip nhằm tăng cường an toàn bảo mật cho thẻ ngân hàng. Việt Nam cũng không thể nằm ngoài xu hướng này khi các ngân hàng đang có những động thái tích cực, triển khai áp dụng tiêu chuẩn thẻ chip nội địa

Xem chi tiết

Add a bank alert trick trick to steal money in the account

Although banks have repeatedly warned of high-tech criminals cheating on OTP codes, requiring login to fake bank websites to steal customers’ money, there are still many people trapped. Agribank has continued to warn tricks of branding, website, relatives, bank officials, postal staff, law enforcement agencies … with many scenarios to steal customers’ account information. ,

Xem chi tiết