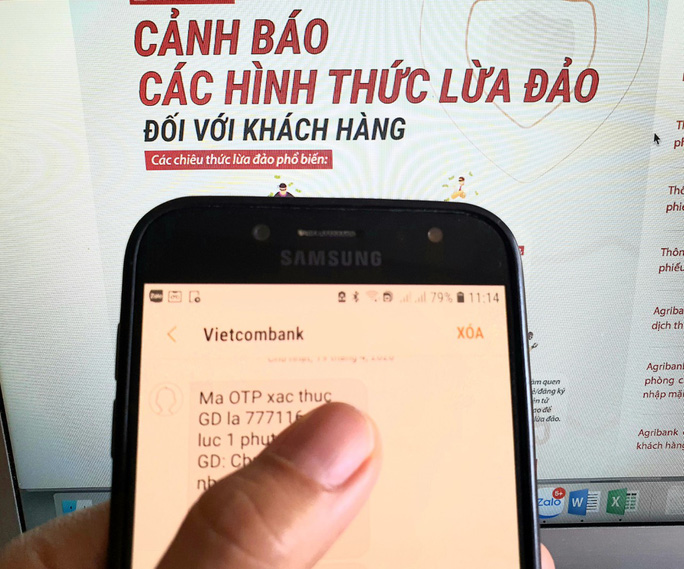

Although banks have repeatedly warned of high-tech criminals cheating on OTP codes, requiring login to fake bank websites to steal customers’ money, there are still many people trapped.

Agribank has continued to warn tricks of branding, website, relatives, bank officials, postal staff, law enforcement agencies … with many scenarios to steal customers’ account information. , appropriating money.

Recently, an online salesman in Hanoi was cheated by fraudulent tactics. According to Agribank, Ms. N., (living in Hanoi) regularly sells online, especially during the prevention of Covid-19. Recently, when an order was placed, she took the initiative in requiring customers to transfer money before delivery. The fraudster sent her via e-wallet, and sent the link on the website trangdientu.com to confirm receipt of money.

This is a fraudulent website, asking you to confirm your name and password to log in to Internet Banking / Mobile Banking and to gradually authenticate OTP code to notify the phone and get withdrawn.

“Although it is” taking money “into the account, Ms. N.’s steps are the” withdrawing “money from her own account,” a representative of Agribank warned.

Another trick that has been warned but still has a snare is a fraudster who calls the victim’s phone number and says it is related to a criminal organization that police authorities are investigating. transfers.

At the end of March 2020, Ms. H., (from Bac Giang province) received a call from a strange phone number +882363822300, 0348010030 saying that this is a police phone number in Da Nang City investigating a trading line. drugs, in which Ms. H., was involved. To prove not participating in this line, Ms. H., must immediately transfer over 940 million to a bank account in Da Nang, otherwise will be arrested. Since then, the subject repeatedly urged her to transfer money.

“After listening, Ms. H., rushed to Agribank in Bac Giang province to withdraw the savings book for bank transfer. Realizing this is one of the fraudulent tactics, Agribank’s leadership in Bac Giang province proactively invited the City police Bac Giang came to work, directed her to the function department of the provincial police for help. The strange phone number did not contact Ms. H. anymore, “- Agribank representative recounted.

Some banks said that from the beginning of the year, many cases of customers receiving impersonation calls to trick customers into transferring money. Old tricks but more sophisticated tricks.

Vietcombank has also warned a new trick when fraudsters take advantage of the Covid-19 epidemic. Some common tricks of crooks such as forging state agencies, disease prevention function agencies, National Epidemic Prevention Committee, Ministry of Health … to send email (email) have Covid-19 related topics such as “Updated information on Covid-19”, “Selling Covid -19 quick test kit” or “Medical Declaration related to Covid -19” …

These emails attach files containing viruses, malware or links to website addresses, applications that store files containing viruses, malicious code. When the email recipient accesses, the malicious code will automatically be downloaded and installed on the recipient’s personal device, steal information and then conduct a property appropriation transaction afterwards.

In order to avoid unjust money, banks recommend that customers comply with safe transaction instructions, absolutely protect personal information from account codes, electronic banking login passwords, card numbers. , card expiry date, CVV card number, OTP code … Do not provide this confidential information to any individual or organization through fake links, email, phone, text.

Source: https://nld.com.vn/kinh-te/them-ngan-hang-canh-bao-chieu-lua-danh-cap-tien-trong-tai-khoan-20200502111815025.htm

Tin tức khác

Vietbank – Ngân hàng có sản phẩm, dịch vụ sáng tạo tiêu biểu 2020

Ngày 26/11/2020, Ngân hàng Việt nam Thương tín (Vietbank) vinh dự nhận giải Ngân hàng có sản phẩm, dịch vụ sáng tạo tiêu biểu 2020 do Hiệp hội Ngân hàng Việt nam và Tập đoàn Dữ liệu Quốc tế (IDG) trao tặng. Đây là giải thưởng thường niên uy tín trong cộng đồng ngân hàng

Xem chi tiết

Advantages of 3D-Secure 2.0 security technology

3D-Secure is an extra layer of protection for Vietcombank cardholders to enhance safety, security and convenience when making transactions online. With this method, when performing transactions on e-commerce websites, besides normal authentication steps, Vietcombank will send an additional one-time transaction password (OTP) via text message or email for customers to enter and complete the transaction.

Xem chi tiết

Ngân hàng đau đầu với chi phí chuyển thẻ từ sang thẻ chip

Giá phôi làm thẻ chip đắt gấp 20-30 lần so với giá phôi làm thẻ từ. Dù chi phí chuyển đổi thẻ ATM làm bằng thẻ từ sang thẻ chip là rất lớn, nhưng đây là việc làm cần thiết vì quyền lợi của chủ thẻ. Theo đại diện của các ngân hàng (NH) ở

Xem chi tiết

Consumers advocate the conversion of magnetic cards to chip cards

Chip card is a card that all information is encrypted on chip, more secure than magnetic card and will limit the situation of information theft, cash withdrawal at ATMs. To issue chip cards, banks have to spend about 2 USD for a card, 7-8 times higher than a magnetic card. However, representatives of some commercial

Xem chi tiết

Thẻ MasterCard (MasterCard card) là gì? Những điều cần biết về thẻ Mastercard

Thẻ MasterCard (tiếng Anh: MasterCard card) là bất kì thẻ thanh toán điện tử nào sử dụng mạng MasterCard để xử lí các thông tin giao dịch. Chúng có thể là thẻ tín dụng, thẻ ghi nợ hoặc thẻ trả trước. Thẻ MasterCard (MasterCard card) Khái niệm Thẻ MasterCard trong tiếng Anh là MasterCard card. Thẻ MasterCard là

Xem chi tiết

Thẻ chip EMV là gì? Tại sao nên dùng EMV thay cho thẻ từ?

Khi rút tiền/thanh toán bằng thẻ chip EMV thì bạn chỉ mất vài giây để giao dịch hoàn tất, thực tế quy trình xử lý giao dịch của nó rất phức tạp nên nó có bảo mật cực kỳ cao. Thẻ chip EMV là gì? EMV là viết tắt của Europay, MasterCard, Visa. Đây là liên

Xem chi tiết