What Is Dynamic Currency Conversion?

Dynamic Currency Conversion or DCC is a service where a cardholder is offered a choice at the point-of-sale to pay in their own currency during an eligible card transaction instead of the default currency offered by the merchant or dispensed at the ATM.

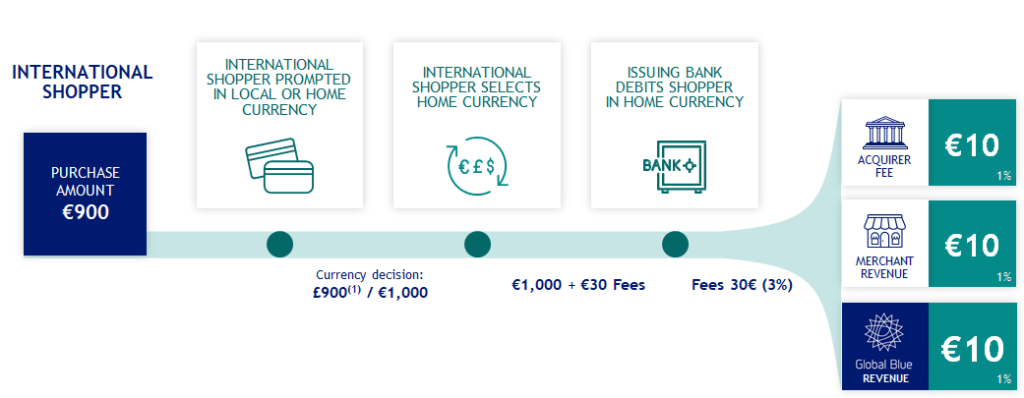

If the cardholder accepts the DCC offer, then the sale or cash dispense amount is converted to the cardholder’s billing currency at an exchange rate offered by the merchant (in conjunction with the acquirer and/or Global Blue). The transaction is then processed with the participating card scheme using the cardholder’s billing currency. Because the amount is already converted, the card issuer won’t need to convert it when they receive the transaction request for approval.

If the cardholder declines the DCC offer, then the transaction will be processed to the participating card scheme in the default currency. The card scheme or card issuer will convert the amount to the cardholder’s billing currency when the transaction is settled by the card issuer to the cardholder.

Global Blue adds a foreign exchange mark-up during the conversion which is funded by the cardholder. This foreign exchange commission is usually shared by the merchant, acquirer, and Global Blue. DCC transfers the commission that would ordinarily be retained by the card scheme and card issuer to the merchant, acquirer, and Global Blue.

Merchant Benifits

Merchants will receive a share of the Foreign Exchange revenue (previously lost overseas) by way of a rebate. Rebates are automatically deducted from your merchant fees reducing the cost of doing business. The rebate will vary depending on the percent of opted-in volume at the end of each month.

Merchants can expect an unprecedented level of attention and customer service, which may differ from their usual experiences with a bank. This dedicated service aims to guarantee that merchants achieve the highest possible savings through the DCC service

Customer Benifits

Lock in rate

This means that what they see on their receipt will match their statement dollar for dollar. If however, for example, customer chooses local currency that transaction will not reach their account until up to a week later, by which time the rate may have changed. This can be a gamble for customer as it could be lower or higher - this cannot be predicted. Therefore, even if customer were to look up what rate their banks was offering that day and calculate the difference to what we were offering the entire calculation will be completely void as the rate will be different by the time it hits their bank account

Easy budgeting

Because everything is disclosed on the receipt and the rate is locked in, customer will know exactly how much of their own money they will have left in their account after the transaction. Knowing exactly how much they are being charged in their home currency gives customer peace of mind, by selecting currency to perform this conversion they eliminate the uncertainty of what will appear on their statement and what other foreign exchange fees etc. they would be charged.

Full Disclosure

Unlike almost all other types of foreign exchange transactions performed by international travellers the DCC solution provides full disclosure of all fees and margins (if any) that are applied to the transaction at the time of purchase . Foreign transactions (when DCC is not applied) are typically marked-up by the cardholder’s issuing bank however the cardholder is generally not aware of how much this will be until they reach home and review their credit card statements. The DCC solution presents all this information to the cardholder before their purchase is authorised and money debited from their account.

How Dynamic Currency Conversion work

The payment terminal automatically detects eligible international credit cards and converts a transaction from the original merchant’s local currency to the eligible foreign currency of the cardholder at the point of sale. A DCC offer is automatically displayed on the terminal screen allowing the cardholder to make an active choice and continue to process in the “offered” currency or merchant local currency, whichever they choose at the time of the transaction. If the card is domestic, it is not eligible for an offer, and the payment is processed in the merchant’s local currency. Global Blue offers many of the major and minor foreign currencies. The DCC process is both quick and simple. This allows the normal flow of business to continue without interruption. It is also very simple from a “back of house” perspective. All payments are processed to the merchant’s account in a single daily local currency settlement. Further to that you do not need to alter your existing banking arrangements.