Convert from ATM technology card to chip card to minimize the risk of losing money

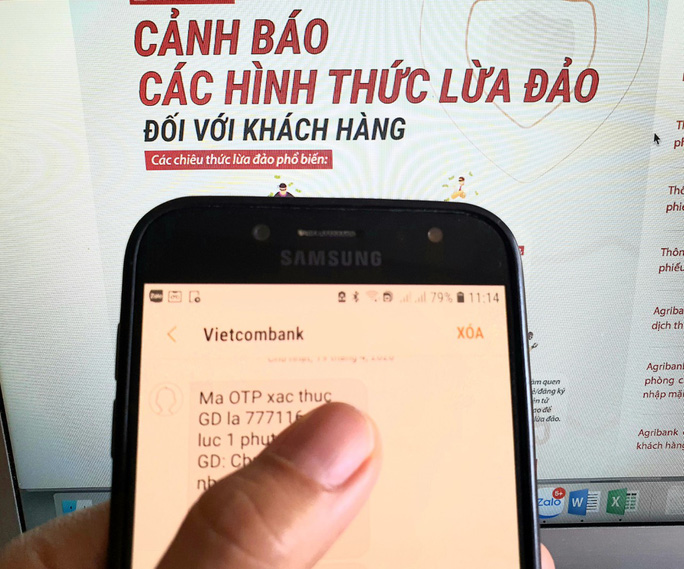

Despite repeated alerts, a series of cases of attaching device to steal card information (skimming) at ATMs, cheating users to get passwords, OTP codes and then taking money still occurred. Banks (banks) are urgently responding to card technology crimes.

Sophisticated tricks

The latest case is that the Ha Tinh Police Department is looking for a man who has skimming at an ATM of a bank located in Ha Tinh City. Previously, this bank reported that police had a stranger installing skimming to copy customer information via ATM. According to the extracted camera of NH, in less than 1 minute, the subject has successfully installed skimming, attached to the keyboard to collect data through micro cameras … After obtaining information, card account data , object will make counterfeit ATM cards to withdraw money, appropriating customers’ money.

Recently, Nghe An province’s police also arrested a group of Chinese people who had the act of installing skimming to steal information to make fake cards, appropriate property. According to Nam A Commercial Joint Stock Bank, in Vietnam, one of the sophisticated ways that crooks often use today is to use electronic devices attached to the card reader slot of ATMs. Anyone withdrawing money will quickly be copied card information and pin code. After stealing data, crooks will multiply into a new card to withdraw money. The person who steals the card information is often unaware until there is a notice of unexpected, continuous deduction or when the card is illegally used and the bank refuses the transaction. “The new technology skimming device is designed by a crook compact, inserted deeply into the card reader at ATM and attached, drawn out very quickly, so it is difficult to detect” – representative of Saigon Thuong Commercial Joint Stock Bank Tin (Sacombank) said.

Mr. Tran Quoc Anh, Head of Retail Banking Division of Ho Chi Minh City Development Commercial Joint Stock Bank (HDBank), said that card crimes are often transnational crimes (mostly foreigners). “low-lying” areas, such as in Vietnam, as local cards are still using magnetic technology.

Quickly convert 21 million ATM cards to chip cards

In response, according to Sacombank, in addition to applying preventive measures to attach new skimming, this bank also enhances the frequency of checking ATM rooms, especially at card readers and the area around the keyboard. “The bank encourages customers to use smartphones to install Sacombank Pay application to make withdrawals with QR codes, replace the use of cards and help customers actively manage the card to ensure the highest safety and security. Sacombank’s ATM and POS have also been upgraded to read local and international chip cards, “Sacombank representative said. Many commercial banks said that card crimes never stop, when the banking system applies new technology solutions, there will certainly be new types of card technology crimes. Therefore, each bank must also apply the synchronous policy. At HDBank, Mr. Tran Quoc Anh said that he has been synchronously implementing card crime prevention solutions, not merely relying on technology. The project conversion process is completed in the fourth quarter of this year.

Vietnam currently has 48 commercial banks issuing domestic cards with an amount of about 76 million cards, more than 261,000 POS and 18,600 ATMs. In Circular No. 41 on the roadmap for converting domestic technology payment cards from to domestic chip cards, the State Bank has requested a specific route for the conversion of all ATM cards to electronic chip-attached cards. , all important information is encrypted. By the end of this year, at least 30% of the cards in circulation must comply with the local standard for chip cards domestically, or about 21 million ATM cards must be converted to chip cards. The deadline for the conversion of all ATM cards in the market to chip cards is the end of 2021. Since the end of May, many commercial banks have started to convert cards under the technical support of National Payment Joint Stock Company. Vietnam (Napas). Banks converted to rolling form, issued domestic chip cards to new customers and then gradually converted for customers who were using ATM cards with magnetic technology. Up to now, the latest information from Napas said that this unit has supported the conversion for banks such as ACB, SCB, SeABank … Previously, the first 7 commercial banks have coordinated with Napas to deploy the transfer roadmap. Exchange, issue ATM cards with the first chips to the market are Vietcombank, BIDV, VietinBank, Agribank, Sacombank, TPBank and ABBANK.

According to the State Bank, domestic chip cards will limit the risk of fraudulence in card payment. This is also an indispensable trend for countries in the region and the world in the face of the increasing number of high-technology crimes and focusing on markets that have not yet implemented the conversion of chip technology.

(Source: Labor Newspaper)

Tin tức khác

Giải pháp trong lĩnh vực ngân hàng

Cùng với sự phát triển thương mại toàn cầu, các ngân hàng và các nhà cung cấp dịch vụ thanh toán không ngừng tìm kiếm các giải pháp thanh toán mới để đáp ứng được các thách thức mà các điểm chấp nhận thanh toán thẻ gặp phải. Họ cần cung cấp các giải pháp

Xem chi tiết

Add a bank alert trick trick to steal money in the account

Although banks have repeatedly warned of high-tech criminals cheating on OTP codes, requiring login to fake bank websites to steal customers’ money, there are still many people trapped. Agribank has continued to warn tricks of branding, website, relatives, bank officials, postal staff, law enforcement agencies … with many scenarios to steal customers’ account information. ,

Xem chi tiết

All 6 types of papers are about to change, the people of the country benefit

In the coming time, it is expected that there will be a “revolution” involving a series of important papers for each citizen – a new step in the efforts to reform administrative procedures of the authorities. permission. 1. Identity of the citizen attached to the chip The Law on Citizen’s Identity stipulates that, starting from

Xem chi tiết

Thẻ chip chuẩn EMV: Tổng quan những điều cần biết

Thẻ ATM sử dụng công nghệ chip điện tử kết nối thanh toán chuẩn EMV đã chính thức ra mắt tại 7 ngân hàng thương mại tại Việt Nam. Để giúp bạn đọc sử dụng thuận tiện, an toàn, thoibaonganhang.vn giới thiệu một số thông tin và những lưu ý đối với sản phẩm này.

Xem chi tiết

Chip cards offer additional opportunities to accelerate cashless payments

Vietnam National Payment Joint Stock Company (Napas) has officially broadcasted information to start converting magnetic cards into chip cards. This is an effort in the direction and administration of the State Bank of Vietnam as well as Napas – the unit assigned to be the focal point in the plan to convert magnetic cards to

Xem chi tiết

COVID-19 Translation: The State Bank implements solutions to support customers

On February 24, the State Bank of Vietnam issued Document No. 1117 / NHNN-TD on the implementation of customer support solutions due to the impact of the COVID-19 epidemic. Accordingly, the current acute respiratory infection due to the new strain of Corona virus (outbreak of COVID-19) is complicated, affecting production and business activities, thereby affecting

Xem chi tiết