Most ATM cards in use today mainly use magnetic technology. With this technology, the card information has been hacked and changed easily …

The advent of ATM has created a major breakthrough, completely changing the trading habits of Vietnamese people. Until now, the ATM card has become a familiar tool, “the object of separation” with many consumers. Integrating the utilities of a “smart wallet”, ATM cards also contain potential risks and financial risks if not careful in using.

The following rules will help you use your ATM card safely, securely, and minimize losses in financial transactions.

1. PIN security

For each ATM card issued, the Bank always recommends that customers change PIN and maximum security to minimize the risks that may be encountered. Remember to always cover the keypad when entering your PIN every time you make a transaction at an ATM.

Also, do not put PINs that are closely related to cardholders or easy-to-remember numbers, etc. if you do not want your bank card to be stolen by bad guys.

2. Use the balance notification service via SMS

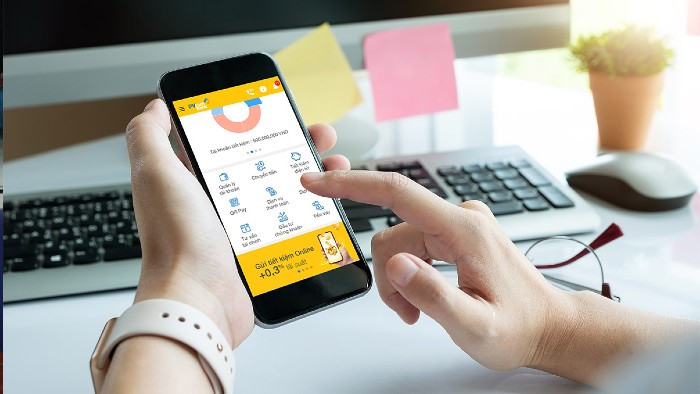

Regularly checking your account balance is also an essential element to help you keep informed of your account fluctuations promptly. Based on mobile platform and digital technology, we can fully grasp the account balance via SMS or Mobile Banking application quickly and accurately.

3. Check your ATM carefully before trading

Sharing with the reporter about his experience when he was a victim of tricks to steal information from an ATM, Ms. Minh Thu – Ba Dinh District – Hanoi said: “In the past, because of subjectivity, I had stolen information and lost all money in the account without even knowing. Since then I have to be more careful, always carefully watching the ATM before trading. ”

Not only Ms. Thu, many cases have become victims of high-tech crime. In fact, there are too many sophisticated tricks, taking advantage of technology’s loophole to appropriate property through an ATM card.

Facing this situation, many banks also give advice to customers that they should carefully watch the ATM before trading, especially the card reader, the keyboard because these are high risk positions. mount tracking device. If you find any suspicious signs, please stop trading and notify the authorities to solve promptly.

4. Lock the card as soon as the information is suspected

Once you lose your card or suspect your ATM has just been attached to a transaction, you need to immediately contact the bank to lock your account. Many banks have implemented the card opening / locking service on Mobile Banking or Internet Banking application to support customers to act as quickly as possible. This service allows users to proactively lock accounts without having to go to the bank, helping to limit exposure during the complicated stage of the Covid-19 epidemic.

5. Use a chip card instead of a magnetic card

Most ATM cards in use today mainly use magnetic technology. With this technology, the card information has been hacked and changed easily. Meanwhile, the domestic security chip card of EMV international standard with many outstanding utilities will be the optimal choice to minimize the risk of losing money to customers.

With EMV chip cards, users can access modern payment methods such as contactless payment technology, cashless payment for most areas such as health, education and public services. etc. bring new experiences and absolute peace of mind.

Especially with the contactless feature (contactless), customers can pay by just one touch of the card to the POS machine without contacting the salesman when having to give the card. This is also a special utility to help users minimize exposure, minimize the spread of Covid-19 in the community – a feature that conventional magnetic cards do not meet.

With the modern digital technology platform, the complete replacement of magnetic card to chip card is an indispensable step to limit risks for customers when trading via ATM in the face of increasing technology crime. .

In the coming period, banks will deploy the conversion and synchronization of 100% of chip cards in the market, meeting the needs of information security and safety of ATM cards used by millions of customers.

Source: https://bizlive.vn/ngan-hang/5-nguyen-tac-vang-giup-ban-su-dung-the-atm-an-toan-3542639.html

Tin tức khác

Hàng loạt vụ trộm tiền trong “chớp mắt” và cảnh báo người dùng thẻ tín dụng

Liên tiếp các vụ tấn công “hack” thẻ visa để trộm tiền đang là nỗi lo lắng của nhiều ngân hàng và người dùng thẻ. Thủ đoạn tinh vi, lợi dụng người dùng sơ hở, bọn tội phạm đã đánh cắp thông tin tài khoản thẻ visa để thực hiện chiếm đoạt tài sản. Liên

Xem chi tiết

50% discount on citizen identification fee with chip

According to Circular 112/2020 / TT-BTC, the citizen identification fee is reduced by 50% for a period of 6 months, from 1/2021 to the end of June 2021. The Ministry of Finance has just issued Circular No. 112/2020 / TT-BTC guiding the collection of a number of fees and charges to support, overcome difficulties and

Xem chi tiết

Vì sao cần phải sử dụng thẻ chip ATM

Tăng cường an toàn, bảo mật thông tin cao, hạn chế tối đa rủi ro về gian lận, lấy cắp thông tin thẻ (skimming)… là những ưu điểm vượt trội mà thẻ công nghệ chip mang lại. Thời gian gần đây, các ngân hàng đang cấp tập triển khai áp dụng thẻ ATM theo chuẩn

Xem chi tiết

Nếu không thanh toán thẻ tín dụng có sao không?

Không thanh toán thẻ tín dụng gây ra nhiều hậu quả không tốt cho chủ thẻ, thậm chí chủ thẻ có thể bị truy cứu trách nhiệm dân sự hoặc trách nhiệm hình sự Số lượng người dùng sử dụng thẻ tín dụng ngày càng đông vì đây là hình thức thanh toán tiện lợi

Xem chi tiết

“Chiping” to limit risks

Upgrading the card issuing system will have to go along with the upgrade of the switching system. Banks have to invest more, but they have to accept because this is an indispensable demand, in line with the general trend of countries around the world, contributing to ensuring security, safety, information security, preventing prevent frauds in

Xem chi tiết

Thanh toán không tiền mặt: Cần cả sự quyết liệt từ quản lý nhà nước

Để thúc đẩy thanh toán không tiền mặt cần phải có giải pháp cụ thể, chứ không chỉ là tuyên truyền… “Thách thức làm chậm quá trình chuyển đổi từ thẻ từ sang thẻ chip, nguyên nhân do đâu?” là vấn đề đầu tiên đặt ra trong phiên thảo luận tại Diễn đàn Phát triển

Xem chi tiết