Currently there are many ways to pay with a POS card when we buy, shop, … But in Vietnam, there are 3 most common payment actions are

Coffee card

Insert the card with the chip

Add a card to Smartphone to pay (Currently only Samsung Pay)

I share a bit about the action of the card (for the magnetic card) and put the card with a Chip.

Between these two forms, the card is more convenient, you do not have to spend a lot of time waiting for the POS machine to load data, if you are using a credit card, you do not need to enter a PIN.

Payment by inserting a card with a Chip (Chip Card) can take from 6s to 12 seconds for some POS to read data, worse than I have encountered a few cases where shoppers are too hasty to forget the card in the POS machine, This is not the case when you swipe the card as you will directly hold the card in your hand and withdraw it.

However, in terms of security, Chip Cards will have advantages over Magnetic Cards (swipe cards). Why?

In the black strip to swipe the card there is a strip of code so when we pay it will sync directly with your bank account. This code is unencrypted, and cannot be changed, in other words, a fixed code

The unencrypted code will make it easier for thieves to steal your account, once information is available, the thief can get many other times.

This will not happen to the Chip Card, the Code data contained in the Chip Card is continuously encrypted with the bank account, when you pay, the thief can not steal that code anymore because it is constantly changing. .

Payment by Smartphone

The first is Samsung Pay, although in Vietnam there is only Samsung Pay but not yet able to use Apple Pay for iPhone users.

Payment via Samsung Pay just touch the phone to the POS device is complete, avoid the risk of information theft when you pay via hard card. Called the short-range NFC solution (Near-Field Communications), but not all POS machines have NFC, Samsung Pay has built-in Magnetic Secure Transmission (MST) technology for magnetic payment, available on all devices. Read the current card.

The security of Samsung Pay is similar to the encrypted code on the Chip Card, the code will constantly change after each payment to prevent hackers.

You will not need to carry a card, carry money, carry a wallet, to avoid other personal risks.

Pay with Timo or Momo, ZaloPay, …

These are also very convenient payment methods for you to avoid the risk of stealing your card information as mentioned above or the hassle of having to hold the card in your body.

Tin tức khác

Add security solutions, increase safety in banking transactions

Attach security to digital banking In order to ensure smooth, safe and accurate digital banking services, banks have been constantly “racing” to invest in technology to ensure information safety and security. A survey by the Vietnam Cyber Emergency Response Center shows that 100% of credit institutions invest in security solutions, from basic to advanced. From

More

Xu hướng thanh toán Thẻ không tiếp xúc lên ngôi

Với nhiều tiện ích và độ bảo mật cao, thẻ contactless (thẻ không tiếp xúc) được dự báo sẽ là xu hướng thanh toán trong thời gian tới, đặc biệt trước bối cảnh dịch COVID-19 đang diễn biến phức tạp và những lo ngại về lây lan dịch bệnh khi sử dụng tiền mặt Tổ

More

Chuyển đổi số phải đi kèm bảo mật rủi ro

Các ngân hàng đang tích cực chuyển đổi thẻ từ sang thẻ chip, và dự kiến sẽ hoàn tất việc chuyển đổi trong năm sau, theo lộ trình của Ngân hàng Nhà nước. Theo ông Nguyễn Trọng Đường, Phó cục trưởng Cục An toàn thông tin (Bộ Thông tin và Truyền thông), cùng với sự

More

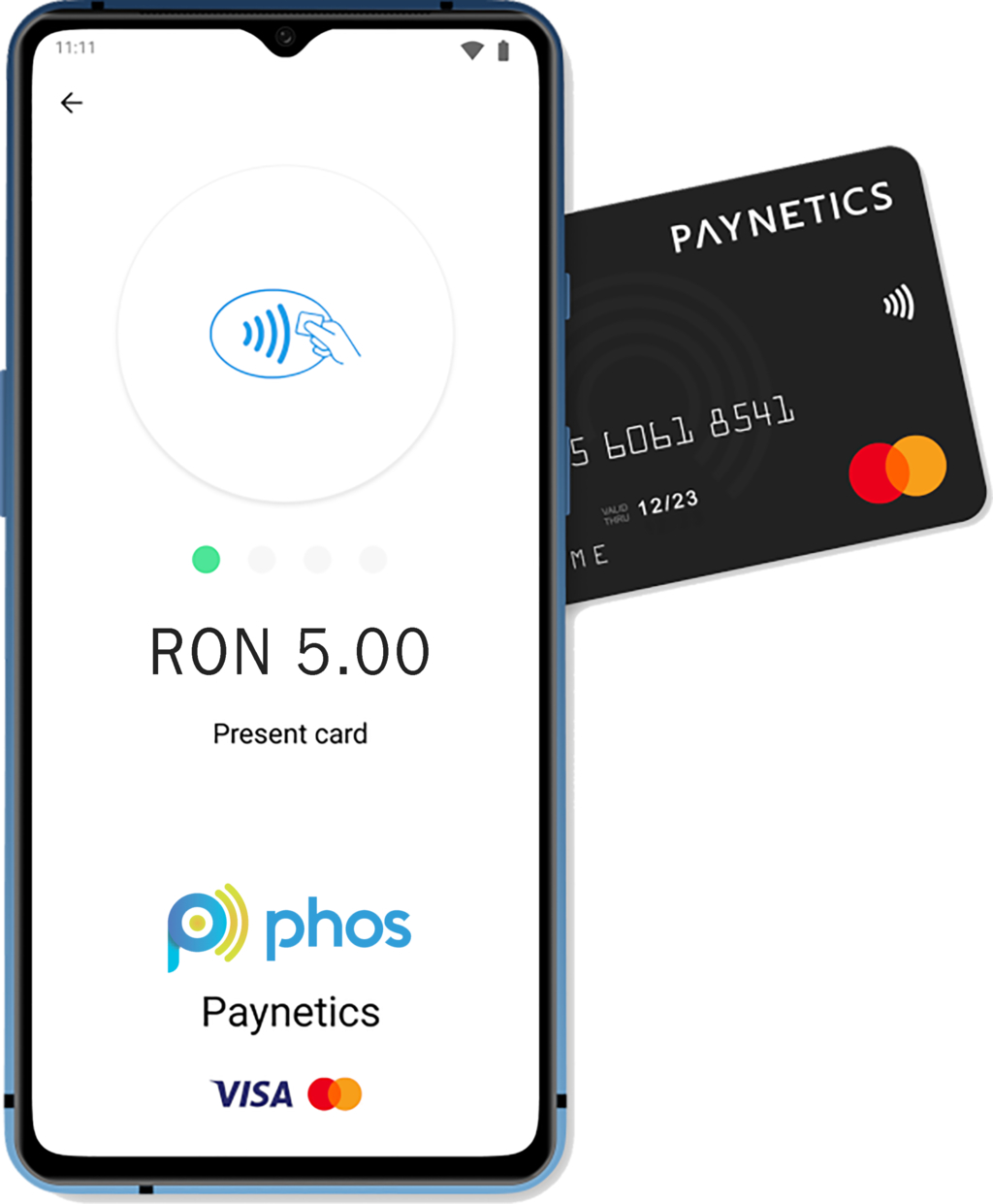

4 EUROPEAN COUNTRIES PAYMENT WITHOUT EXPOSURE WITHOUT ANDROID NFC AND PHONE

Merchants in 4 countries including the UK, Germany, Bulgaria and Romania will participate in testing the new mobile POS service (mPOS) to allow contactless payments to be accepted on Android mobile devices without the need for additional any “lock or hardware”. Mastercard has partnered with new software companies Phos and Paynetics specializing in mobile POS

More

Người tiêu dùng ủng hộ việc chuyển đổi thẻ từ sang thẻ chip

Thẻ chip là thẻ mà toàn bộ thông tin được mã hóa trên con chip, bảo mật hơn so với thẻ từ và sẽ hạn chế được tình trạng ăn cắp thông tin, rút tiền trộm tại các cây ATM. Để phát hành thẻ chip, các ngân hàng phải mất khoảng 2 USD cho một

More

Domestic credit cards: Increasing convenience for customers, repelling black credit

The advantages of domestic credit cards have attracted customers’ attention and are expected to contribute to repelling black credit. In recent years, the COVID-19 epidemic has had a great impact on the banking and financial market in general and the payment sector in particular. However, this is also an opportunity for non-cash payment services to

More