Chip card (English: Chip card) is a plastic debit or credit card with the standard size and contains a chip located on the front of the card.

Chip cards

Concept

Chip cards in English have many ways to call such as Chip card, smart cards, chip-and-pin cards, chip-and-signature cards, Europay – MasterCard – Visa (EMV) cards.

A chip card is a standard-sized plastic debit or credit card and contains a chip located on the front of the card. Chip encrypts information to increase data security when making transactions at stores, terminals or automated teller machines (ATMs).

Why use a chip card instead of a magnetic card?

High information security

Magnetic cards have relatively low security, so it’s not surprising that the oldest Skimming devices can steal ATM card information of users, making a lot of customers suffer because the money doesn’t fly … For this reason, we should turn to chip cards for greater peace of mind when withdrawing money or making payments.

When inserting a magnetic card into an ATM and entering a PIN, the information is stored in magnetic strips and will be transmitted as “bare” text, so just a regular scanning device will immediately know the PIN / card number. .. your.

As for the chip card, the above information will be encrypted one more step in the form of a digit string in the binary format of the computer, and this code is constantly changing so suppose the hackers are lucky to decode and get The information is also difficult to reuse …

The principle works closely

Contrary to magnetic cards, whenever a chip card is used for payment, the chip generates a unique and never-repeated transaction code. In case a customer’s card is stolen from a certain store, the fake card will never work because the stolen transaction code will not be reused, the card will be rejected.

In order for a successful chip card transaction, you will have to go through two-dimensional complex verification steps from the device to the payment bank, Mastercard / Visa and the issuing bank. When licensed by all related organizations, the transaction is successful.

The processing of chip cards is a little more complicated than magnetic cards because there is a more Visa / MasterCard organization involved in card verification, the process is closed and circular but it only takes a few seconds to be accepted to request access. access your account by card, not from a lot of magnetic cards.

Banks are offering chip cards

Besides international banks such as HSBC, CitiBank … Vietnamese banks are also on the path of converting all to chip cards. There are many major banks introducing international credit and debit cards with advanced chips such as: VIB, VietinBank, VietcomBank, Techcombank, ACB, Sacombank … In the future, surely all banks must convert. to Chip card for customer security and safety.

Some notes when using chip cards

Do not withdraw money at ATM outside the system because the fee is very high (4% / amount, at least VND 50,000); Only transfer within the system via ATM; Chip cards are international cards, so they can be purchased online, used globally. You should also delete the CVV number on the back of the card; The annual fee is only VND 30,000 higher than the card depending on the bank.

Most customers are using domestic debit cards (known as ATM cards), which are magnetic cards. Moreover, it is mainly used to withdraw money at ATMs, which is the place where hackers can easily hack the card information, so switching to chip cards will be much more secure.

(Reference: thebank.vn, investopedia.com)

Tin tức khác

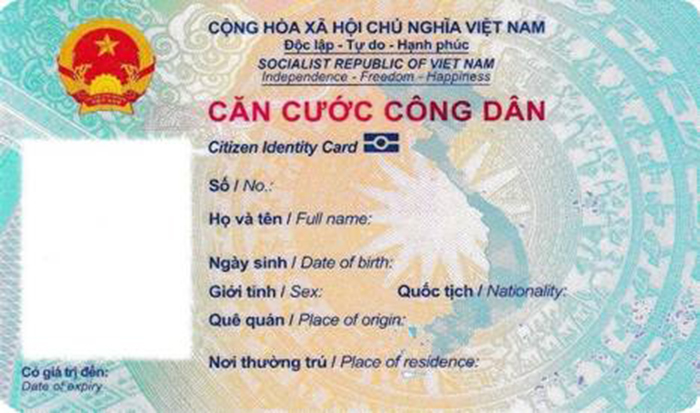

Quy định về mẫu thẻ Căn cước công dân gắn chíp điện tử

Mẫu thẻ Căn cước công dân (CCCD) theo Thông tư số 06 có gắn chíp điện tử và lưu trữ thông tin cơ bản của công dân, cùng hai ngôn ngữ tiếng Việt và tiếng Anh. Thông tư số 06/2021/TT-BCA quy định về mẫu thẻ Căn cước công dân (Thông tư số 06), gồm 05

More

Nam A Bank shook hands with Appotapay e-wallet

Nam A Bank and AppotaPay Joint Stock Company have just signed a cooperation agreement, contributing to providing convenient financial services to customers based on the strength of modern technology. Accordingly, Nam A Bank and AppotaPay signed an agreement to sign cooperation services such as: Linking e-wallet, payment gateway, collection on behalf of … At the

More

Diễn đàn phát triển hệ sinh thái thanh toán điện tử 2019 ” Chuyển động cùng công nghệ chip”

Ngày 10/12/2019 tại Hà Nội, Thời báo Kinh tế Việt Nam, Công ty Thanh toán Quốc gia Việt Nam (NAPAS) và Vụ Thanh toán – Ngân hàng Nhà nước chủ trì tổ chức Diễn đàn Phát triển hệ sinh thái thanh toán điện tử 2019 với chủ đề “Chuyển động cùng công nghệ CHIP” (EPF

More

Converting magnetic card to chip card: Increasing security and safety when using the card

Under the direction of the State Bank, Vietnam Bank Card Association (VBCA) in collaboration with Vietnam National Payment Corporation (NAPAS) officially launched domestic chip card products. The Securities Investment Newspaper had an interview with Mr. Tran Cong Quynh Lan, Deputy General Director of VietinBank, one of the first 7 banks to deploy this event. Switch

More

The first 7 banks converted magnetic cards into local chip cards

On the afternoon of May 28, Vietnam Bank Card Association cooperated with Vietnam National Payment Joint Stock Company (Napas) along with 7 banks namely Vietcombank, BIDV, Agribank, VietinBank, Sacombank, ABBank and TPBank announced launch of local chip card products of banks. Speaking at the event, Ms. Nguyen Tu Anh, Napas President, said that converting magnetic

More

Thẻ chip bắt đầu thay thẻ từ

Các NH chuyển đổi trong đợt đầu, gồm Vietcombank, VietinBank, BIDV, Agribank, Sacombank, TienphongBank và An Bình, với số lượng thẻ ATM chiếm khoảng 70% tổng số thẻ trên cả nước, chưa kể một số NH khác cũng đang đăng ký chuyển đổi với Công ty CP Thanh toán quốc gia VN (Napas). Việc chuyển

More